Bookkeeping

now browsing by category

Enrolled Agents Frequently Asked Questions Internal Revenue Service

Contents:

CPAs also audit businesses and provide assurance that their financial statements are free from material misstatement. CPAs are licensed in their state, while enrolled agents are licensed federally. To become an enrolled agent, you need to pass a three-part exam or work at the IRS for at least five years. CPAs typically must earn a bachelor’s degree plus 30 additional credits in accounting.

TurboTax vs. hiring an accountant: What’s the best way to do your … – Morningstar

TurboTax vs. hiring an accountant: What’s the best way to do your ….

Posted: Mon, 17 Apr 2023 14:01:00 GMT [source]

These practitioners may represent their clients on any matters including audits, collection actions, payment issues, tax refund matters, and appeals. FATP status is also granted with limited representation rights to enrolled actuaries, and enrolled retirement plan agents. An EA is a federally licensed tax practitioner who has technical expertise in the field of taxation and is empowered by the U.S.

What does the term «Enrolled Agent» mean?

There are limits on the total amount you can transfer and how often you can request transfers. Pathward does not charge a fee for this service; please see your bank for details on its fees. Federal pricing will vary based upon individual taxpayer circumstances and is finalized at the time of filing.

In 1884, The Enabling Act, also called the Horse Act, was signed into law. This act created enrolled agents, and it established a standard people needed to meet to become one of these professionals. Enrolled agents deal with individual and corporate income tax, but they also deal with employment tax, sales tax, and other local, state, and federal taxes. When looking for an enrolled agent near me, you should look for an enrolled agent with experience in your state, who specializes in your area of concern.

The right enrolled agent will understand the importance of taxes to your personal finances and will be happy to make any necessary clarifications or give further explanations. A Certified Public Accountant should have a vast knowledge of accounting, auditing, business law, personal finance and taxes. On the contrary, an Enrolled Agent has to be knowledgeable about taxes, as this is the specialty area of an EA. Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider. Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit. Faster access to funds is based on comparison of traditional banking policies for check deposits versus electronic direct deposit.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. Some of this material was developed and produced by FMG Suite to provide information on a topic that may be of interest.

Large jewelry items must be stored in your locker due to concerns over concealed recording devices. Water in a clear or transparent container with a lid or cap must have all labels removed, and the container will be inspected for notes or other prohibited test aids. You will need to remove the lid/cap for visual inspection by the Test Center staff. These inspections will take a few seconds and will be done at check-in and again upon return from breaks before you enter the testing room to ensure you do not violate any security protocol.

File

The CTP® curriculum includes most topics on the EA exam and CTP® graduates are well prepared to pass the EA Exam after completing a Surgent EA Exam Review. Both enrolled agents and CPAs must complete continuing education credits every year. This ensures they stay abreast of changes to the industry and the tax laws. The main difference between enrolled agents and CPAs is their area of focus. Enrolled agents are 100% focused on tax-related issues. CPAs can focus on taxes, but they can also do public accounting, corporate accounting, and accounting for government and not-for-profit organizations.

Enrolled Agent (EA) Definition – Income Tax – Investopedia

Enrolled Agent (EA) Definition – Income Tax.

Posted: Sat, 25 Mar 2017 22:38:33 GMT [source]

Avoid preparers who charge you a percentage of your refund, and never sign a blank or incomplete return. If you think you’ve been scammed, consult this guide and use Form A to file your complaint with the IRS. So, if you think your taxes are too complicated to file yourself using online software and are looking for help from a professional, consider hiring an enrolled agent. You can also check your local yellow pages or a local business directory like Yelp. You can also find some financial advisors who are enrolled agents.

Steps to Becoming an Enrolled Agent

Many of those tax returns were filed with the help of an enrolled agent. One of the most effective options is to search for an enrolled agent near me on TaxCure. At TaxCure, we have a directory of enrolled agents and other tax professionals from around the country. You can easily search for an enrolled agent who has experience with your tax concern in your area.

Year-round access may require an Emerald Savings® account. US Mastercard Zero Liability does not apply to commercial accounts . Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions. Find out about your state taxes—property taxes, tax rates and brackets, common forms, and much more. Payroll Payroll services and support to keep you compliant. Discussed below are the primary differences between EAs and CPAs, which should provide a better understanding of which professional is most suitable for the work required.

Enrolled Agents are America’s Tax Relief Experts

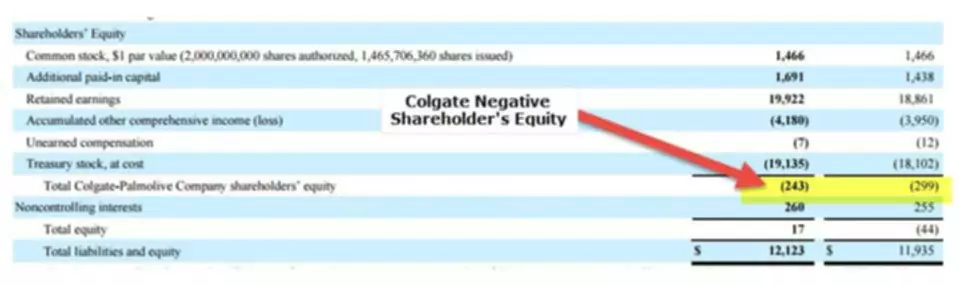

Bring us up to 3 ynormal balancers of past taxes and we’ll find ways to save you money, when we do we’ll help you file to get your money back from the IRS. Another difference that can be seen between a CPA and an EA, is that the former has the right to prepare and sign financial statements, whereas an EA does not enjoy this right. Unlike an EA, a Certified Public Accountant can do financial statement audits. 100% Accurate Calculations Guarantee – Business Returns. If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we’ll pay you the penalty and interest. You are responsible for paying any additional tax liability you may owe.

Gym fees and marijuana: Influencers mix up what’s deductible versus taxable – Yahoo Finance

Gym fees and marijuana: Influencers mix up what’s deductible versus taxable.

Posted: Tue, 18 Apr 2023 20:08:20 GMT [source]

Additionally, it helps existing agents maintain their status. Enrolled agents and CPAs overlap in many ways, and both of these professionals can represent you in front of the IRS. However, there are a few differences between enrolled agents and CPAs. Enrolled agents often charge a fee based on the project, but if they charge an hourly rate, it tends to range from $200 to $400. Some enrolled agents charge less than this range, while others charge more. According to the Bureau of Labor Statistics, the median annual salary for an enrolled agent is $54,890.

Get your max refund

CPAs’ duties and professional offerings are broader than an EA’s. Pass a suitability check, which will include tax compliance to ensure that you have filed all necessary tax returns and there are no outstanding tax liabilities; and criminal background. Successful examination candidates usually have the process completed within 90 days of receipt of their application.

CPAs and attorneys may serve as enrolled agents without taking the exam. Prospective enrolled agents must either pass the Special Enrollment Examination or meet minimum IRS experience requirements. In general, any overdue tax return that has not been filed or any unpaid taxes unless acceptable payment arrangements have been established. Experienced tax preparers can try to test out of the Comprehensive Tax Course to save time and money within the CTP® program. The NAEA Education Foundation (NAEA-EF) has existed since 1972. It helps people who want to become enrolled agents and even offers scholarships to aspiring candidates as they study for their Special Enrollment Examination .

Great knowledgeable team who really know tax codes and help explain things in normal terms. They have been doing our taxes for several years and now they handle many other aspects of our business. They are always there to answer all my questions throughout the year and help me make sure my business is not only set up properly but also doing the best thing financially and from a tax benefit standpoint. Without tax planning, you could end up paying more than you need to in taxes, making having an enrolled agent on your side valuable. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply.

Enrolled Agent Information

Being better prepared for the test experience will allow you to perform better the day of your test. Individuals who obtain the Enrolled Agent status must adhere to ethical standards and complete 72 hours of continuing education courses every three years. Enrolled Agents must use an IRS-approved CE provider.

They save their clients time and money in the long run. Tax laws and the regulations issued by the IRS can be overwhelming. An enrolled agent can assist the taxpayer with understanding the inner workings of the law and know the best strategy to deal with the unique circumstances for their tax-related issues.

Scheduling is now available for an exam appointment for the May 1, 2023 – February 29, 2024 test window. The actual seat time is 4 hours to allow for a tutorial, survey, and one scheduled 15-minute break. There is a $206 fee per part paid at the time of appointment scheduling.

- The capabilities of an enrolled agent extend beyond just preparing returns to areas such as representing clients in cases involving audits, collections, and appeals.

- Discussed below are the steps needed to be taken in order to achieve the EA title.

- Exceptional considering the amount of attention he provides.

Typically the enrolled agent acts as a legal representative for the taxpayer in issues that relate to IRS tax matters. The enrolled agent must pass the three parts of the Special Enrollment Exam which certifies that the agent has proven competence in the areas of tax law. Moreover, enrolled agents must complete 72 hours of continuing education every three years to maintain their status.

I highly recommend Landmark Tax Group, just for the mere fact that they treat you as a human being, Not a cash cow. Each part of the exam is 100 questions; you have 3½ hours to answer the questions for each part. Individual parts are tested as separate exams and all parts must be completed within two years or you’ll have to start over.

Reconciliation in Account Definition, Purpose, and Types

Content

These AAIs define the range of accounts that you want to reconcile and are required for all four methods of account reconciliation. If the trial balance is greater than the aging schedule balance, it is likely due to a journal entry posted directly to the general ledger instead of to the sub-ledger. In addition, let the amount of the difference guide you in your reconciliation. For example, if the difference is $100, look for transactions whose size is close to that. Set up a reconciliation statement or reconciliation report in a spreadsheet, with the trial balance at the top of one column and the balance you will be comparing it to in the other column.

However, depending on the size of your transactions, daily sales volumes, and how large your staff is, you may find that monthly bank reconciliation is sufficient. Balance sheet reconciliation is the process of matching the closing balances of all the accounts of the company that forms part of the company’s balance sheet. It is done to ensure that entries used to reach the closing balances are entered and classified accurately so that balances in the balance sheet are appropriate. Account reconciliations can be performed on a monthly, quarterly, or annual basis. The company’s management team needs to assess which reconciliations have the highest risk of fraud or error, and that will help determine how frequently the account should be reconciled. Additionally, the materiality or the dollar amount of the reconciliation plays a critical role in determining how often the account should be reconciled.

Error Reduction

For example, a company maintains a record of all the receipts for purchases made to make sure that the money incurred is going to the right avenues. When conducting a reconciliation at the end of the month, https://www.bookstime.com/ the accountant noticed that the company was charged ten times for a transaction that was not in the cash book. The accountant contacted the bank to get information on the mysterious transaction.

Along with death and taxes, it’s certain that humans make mistakes. The data and amount of transactions that must be compared within the reconciliation process requires utmost attention to detail. By using automation software, you will save valuable time and make the GL reconciliation process run seamlessly. The software is able to pull all data from the necessary systems and compare the data side-by-side. GL software will automate the workflow, safely store all data, store all policies for quick reference, provide audit trails, and even present your team with templates to standardise the process simply. While it is possible and somewhat common to have discrepancies within your accounts, some will be easily explainable and others will require some investigation.

Stay in control

Versapay’s collaborative AR automation software combines powerful automation capabilities with tools for collaborating with team members and customers, all in one cloud-based platform. In these situations, accounting teams greatly benefit from having a collaborative accounts receivable solution, which allows them to communicate directly with what is an account reconciliation customers in a single platform. Companies like Userlane were able to leverage Chargebee to close their month-end financials in 80% less time, saving them time and allowing them to forecast their cash flow more accurately. A company must complete reconciliation before certifying its financial information and issuing its financial statements.

Access to this page has been denied

After creating your account, everything’s set up so you can get started right away. Your data is always available, and it’s backed up for extra peace of mind. The transactions will appear in your bookkeeping automatically, and you can say goodbye to manual receipt entry. Have an eye on the big picture so you can make better business decisions. Our robust reports are easy to use and show month-to-month or year-to-year comparisons so you can easily identify cash flow trends. When everything is neatly where it belongs, tax time is simple.

Is H&R Block better than TurboTax?

H&R Block's DIY filing options are less expensive than TurboTax across the board and edged out TurboTax in our overall ratings. While TurboTax offers an engaging user experience, H&R Block's online tax interface is more straightforward, cleaner, and less distracting.

We provide different levels of support for customers who use different parts of Wave. Wave is 100% web-based, so you just need an Internet connection and browser. You can, however, download and install our mobile invoicing app for iOS and Android. Wave and QuickBooks are both popular for small businesses, but they each stand alone with their unique offerings. When it comes down to Wave vs. QuickBooks, the right answer lies in the way you run your business. Streamline your payables process with Divvy’s free vendor payment solution. 4.7/5 rated mobile app that brings budgets, virtual cards, and more into a single app.

Receipts

Let’s talk about how your product can solve the business needs of our visitors. It doesn’t allocate the purchased goods under the inventory! It allocated them as COGS directly which mean I need a JE every time I sell any of my goods.

- Explore more details on the competition in our full roundup of the best accounting software for small businesses.

- But our editorial integrity ensures our experts’ opinions aren’t influenced by compensation.

- Registration is free of charge; you don’t have worry about a trial period, and you can cancel your account any time.

- Accounting software with all the time-saving tools that allow you to focus on your business.

- Last but not least, Wave invoice payments automatically sync to your accounting dashboard.

There’s no project management and limited time tracking, which rules the software out for a lot of businesses. Hopefully, with Wave’s track record for updates, it will add these features soon and improve customer service response times. In the meantime, though, check out these top Wave alternatives to fully explore your accounting software options.

Is invoicing software secure?

Managing your financials can be really overwhelming – and for that, Akounto has your back! With Akounto, keep up with your cash flow while on-the-move & enjoy… Zoho Books has an excellent mobile app and fantastic customer service. It’s best known for its invoicing features, which makes it ideal for service-based businesses that frequently need to invoice clients. Zoho Books provides end-to-end accounting software for small and midsize businesses. It offers almost all the same features as QuickBooks, but it’s much more affordable.

- Responses are not provided or commissioned by the vendor or bank advertiser.

- Other features and services, such as payroll and bookkeeping services, come at varying costs of $20 per month to $1500 per year, which are broken down in the table below.

- Wave Accounting is an ideal choice for micro-businesses with less than 10 employees, contractors, freelancers and other service-based businesses on a budget.

- The pricing of the Invoicera wave alternative looks expensive when you try to explore the better version.

- You just have to sign in, and you will get everything that the company has promised you—for free.

- For example, Bookkeeping support costs $149 per month, which can be a lot for small businesses.

With Wave, you can also accept payments, run payroll, and get access to advisors. While the invoicing platform is not easy to integrate with popular third-party payroll apps like Gusto or OnPay, Wave does have its own payroll software. Small businesses that plan wave accounting to hire employees at some point might need to change accounting software systems in the future or upgrade to Wave Payroll. Wave is a free invoicing and accounting software that helps small businesses keep track of their bookkeeping needs from one location.

Who is Wave for?

S not the perfect pick for business owners who want to add accounting features as they grow. And its email-only customer support means users are largely on their own if they encounter an immediate problem. As previously mentioned, Wave offers an optional Payroll app that provides integrated payroll services to customers in eight states . For these eight states, Wave will transfer the appropriate tax payments and file all tax forms. Finally, you can add a product or a service to Wave, but there really isn’t a way to manage inventory, making Wave a much better option if you provide services. If you’re tracking sales tax, you’ll have to enter each appropriate rate in the Sales Tax screen in order to apply it to an invoice.

Wave Review In 2022: Features And Alternatives – BizReport

Wave Review In 2022: Features And Alternatives.

Posted: Wed, 05 Oct 2022 19:51:30 GMT [source]

Income Statement: How to Read and Use It

Content

It is called the single-step income statement as it is based on a simple calculation that sums up revenue and gains and subtracts expenses and losses. The income statement is one of three statementsused in both corporate finance and accounting. The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a retail accounting coherent and logical manner. An income statement is one of three major financial statements used to evaluate the health of a company, along with the balance sheet and cash flow statement. There are several terms you’ll need to understand in order to read an income statement. An income statement is a financial statement that reports the revenues and expenses of a company over a specific accounting period.

What do income statements show?

An income statement shows a company's revenues, expenses and profitability over a period of time. It is also sometimes called a profit-and-loss (P&L) statement or an earnings statement.

A comparison of the line items indicates that Walmart did not spend anything on R&D and had higher SG&A and total operating expenses than Microsoft. These are all expenses that go toward a loss-making sale of long-term assets, one-time or any other unusual costs, or expenses toward lawsuits. These are all expenses linked to noncore business activities, like interest paid on loan money. David Kindness is a Certified Public Accountant and an expert in the fields of financial accounting, corporate and individual tax planning and preparation, and investing and retirement planning. David has helped thousands of clients improve their accounting and financial systems, create budgets, and minimize their taxes. Below is a video explanation of how the income statement works, the various items that make it up, and why it matters so much to investors and company management teams.

Single-step vs. multi-step income statements

Finally, the income statement is helpful in disclosing information about the profits realized by a firm during a financial year. An income statement provides helpful insights into the financial well-being of a company. It allows business owners to come up with better strategies, as well as to evaluate their past decisions. An income statement is also crucial for investors who are looking to put money into a business.

For instance, the cash flow statement shows how money moves in and out of your business and can act as a bridge between the income statement and the balance sheet. A balance sheet gives a point in time view of a company’s assets and liabilities, while the income statement details income and expenses over an extended period of time . A balance sheet helps determine a company’s current financial situation and make important financial decisions.

The context of the income statement template

Our experts choose the best products and services to help make smart decisions with your money (here’s how). In some cases, we receive a commission from our partners; however, our opinions are our own. Many or all of the offers on this site are https://www.harlemworldmagazine.com/retail-accounting-why-is-it-essential-for-inventory-management/ from companies from which Insider receives compensation . Advertising considerations may impact how and where products appear on this site but do not affect any editorial decisions, such as which products we write about and how we evaluate them.

A business continuity plan helps protect your business from the effects of disruption. It is relevant when a company has an investment that has performed badly. There are many rules surrounding when and how these are dealt with.

What is income statement and examples?

An income statement is a financial statement that shows you the company's income and expenditures. It also shows whether a company is making profit or loss for a given period. The income statement, along with balance sheet and cash flow statement, helps you understand the financial health of your business.

QuickBooks and Amazon Business Integration Intuit

Content

Customer, vendor, and account details can be viewed by clicking on the left menu bar. For instance, customer details, including what they owe you, can be viewed by clicking on Sales and then Customers. All transactions in QuickBooks Online can be initiated by clicking the + New button above the left menu bar and selecting from the menu of transactions. Whether you choose QuickBooks Online or Desktop, it’s essential that you familiarize yourself with QuickBooks and how it benefits small businesses. To help you get the most out of QuickBooks, check out our top-recommended QuickBooks training courses.

OnPay vs. QuickBooks Payroll: Which Wins on Customer Support? – The Motley Fool

OnPay vs. QuickBooks Payroll: Which Wins on Customer Support?.

Posted: Wed, 18 May 2022 07:00:00 GMT [source]

It even has some advanced accounting tools for medium-to-large organizations. If you decide QuickBooks Desktop is best for your business, you can either purchase a subscription from Intuit or purchase the software directly from a reseller for a one-time fee. Once you have QuickBooks Desktop up and running, consider using Qbox to share your company file with remote users. Wave accounting says their business accounting software is simple, reliable, and secure and may be accessed online anytime. They offer free accounting and invoicing services and pay-per-use payment plans and subscriptions per month to payroll services. This tool also includes strong reporting that offers standard reports like expenses, profit and loss, and sales tax summaries. You can also link several checking and/or savings bank accounts to the software to get all the transactions there instantly and accurately recorded in the app.

Microsoft Office Home & Student 2021 | 1-device [PC/Mac Online Code]

Once the estimate is an invoice, you can track the payment process based on this estimate receiving payment notifications as soon as they happen. This helps keep everyone on the same page and avoids confusion as the job progresses. As for sales tax, say goodbye to manually calculating it with each sale, QuickBooks will customize the tax rate automatically based on what you sell, where you are, and where you ship. I simply create an invoice, customize a note to my customer, and hit send. Since my QuickBooks account is linked to my ACH bank, my clients pay, and the money is deposited directly into my account.

TaxJar easily integrates with the Seller Central dashboard. You will not have to download or upload spreadsheets or any other files because TaxJar syncs with your account and pulls in the needed information. Gusto starting at $39 per month, then $6 per additional person per month.

Unique Selling Point

And the site’s dashboard, called Overview, includes links to common tasks, a countdown to the next payday, a to-do list, and links to any remaining setup tasks. In order to keep your books in order it’s necessary to keep track of any refunds, and fees that are deposited back into your account, as well as those that aren’t reimbursed. The Source or Payee column displays the bank or credit card account used when you make a purchase. When I explained to the person on the phone that I received a different answer here, from someone it appears is an employee, she sent me the licensing agreement. This points out that we’re only purchasing a license, not the actual software, and that if we don’t continue paying the license we won’t have access to the software anymore.

You will not easily omit or double-record any transactions without being alerted. This is because the transactions are run through your business bank or credit card accounts. On May 21, 2010, Intuit acquired MedFusion, a Cary, https://quickbooks-payroll.org/ NC leader of Patient to Provider communications for approximately $91 million. On June 28, 2011, it acquired the Web banking technology assets of Mobile Money Ventures, a mobile finance provider, for an undisclosed amount.

QuickBooks Amazon Seller Integration

Depends as you mentioned if you have a subscription product or an outright license product. In January 2016, Intuit Inc. announced an agreement to sell Demandforce to Internet Brands. On March 3, 2016, Intuit announced plans to sell Quicken to H.I.G. Capital. On March 8, 2016, it announced plans to sell Quickbase to private equity firm Welsh, Carson, Anderson quickbooks payroll amazon & Stowe. The site includes information including the Internal Revenue Code, Treasury Regulations, Tax Court Cases, and a variety of articles. TurboTax online – Online versions of Free, Student, Standard, Premier and Home & Business. French-language version of TurboTax – offered in de base, de luxe, premier and particuliers et entreprises versions.

- Click here to buy a headset that will give you excellent hands-free reception with a cell phone.

- With the power of people and technology, our team dives deep into COGS and inventory accounting..

- Intuit Canada has employees located all across Canada, with offices in Edmonton, Alberta, and Toronto, Ontario.

- You can review charges, update your payment method, change a credit card, as well as update billing information and email addresses.

- You can find your license number on a brightly colored sticker on the folder inside the box.

- There are 20 of them, some of which offer good customization options.

Even older versions had optional subscription services, were included with a new version but need to pay to renew if you want to use those services. Also they don’t give much if any technical support for older versions. I did transfer 2007 desktop to a newer computer recently, they did help me activate it, but don’t really offer much of any other support for it. Unfortunately having printing issues with it after moving it and am in process of setting up 2021 desktop version to start using soon. 2021 maybe has different look compared to my old 2007 version I don’t think it really has much for new features other than those features are part of the subscription services. Maybe some enhancements but nothing one must absolutely have to do basic accounting for any business type.

In other projects

So, if you bill $100 and your customer keys a card in, you’ll be charged $3.65 for that transaction. It may not seem like a lot of money, but unless you anticipate that charge by adding it into the billable amount, it will add up over time. It’s important for you to know your needs before you start shopping around for an accounting platform.

Intuit formerly offered a free online service called TurboTax Free File as well as a similarly named service called TurboTax Free Edition which is not free for most users. QuickBooks Online is cheaper than QuickBooks Desktop if you have many employees who will be using the program. For instance, QuickBooks Online Plus only costs $85 per month but already includes up to five users as opposed to Desktop’s Premier, which is worth $549.99 for only one user. If you want to add up to five users, you’ll have to pay around $1,700 per year. Choose QuickBooks Online if most of your accounting duties are done remotely and you need a mobile app with a wide range of features. QuickBooks Online is also preferable if you have multiple people needing access to your books. QuickBooks Enhanced Payroll costs $50/month +$2/month per employee .

Onboarding is by far the most challenging and complex part of using any payroll system. If you’re using the site to pay your first employees and don’t have any previous payroll data, you may be able to go through the setup on your own. If Madeline is at your office, she will offer you a 20% discount on ordering Intuit Checks. The deadline for sending W-2’s to employees and 1099’s to subcontractors is Jan 31st.

- Each function includes respective icons that allow you to access and perform certain transactions easily, such as Enter Bills for vendors, Create Invoices for customers, and Enter Time for employees.

- If you already use QuickBooks Desktop, you might be interested in QuickBooks Desktop Payroll as a simple solution to your payroll problems.

- «How much do you pay Dave?» is the introduction to the next task, where you indicate whether Dave is paid an hourly rate, salary, or on commission only.

- What’s particularly important is that all parts of the gross sales amount and any refunds and reimbursements have been recorded in QuickBooks, which replicates the actual money flow.

- QuickBooks Payroll Elite is the highest tier, at $125 per month plus $10 per employee per month.

Rippling’s benefits and human resources administration capabilities are unrivaled in the group of websites I reviewed here. You can also enter historical data on your own using pay stubs and reports from past payrolls. If you live in a state that has complicated payroll tax requirements, you can request help from a payroll agent or consult the QB Assistant bot. I found a helpful step-by-step guide to entering historical data by searching QuickBooks Payroll’s help files and a video through the bot. But many of the answers I received were about accounting service QuickBooks Online or related to other aspects of payroll. For the most part, responses are not prioritized by usefulness either.

Upfs Full Form Police Fill Online, Printable, Fillable, Blank

Content

Bicycle patrols are used in some areas, often downtown areas or parks, because they allow for wider and faster area coverage than officers on foot. Bicycles are also commonly used by riot police to create makeshift barricades against protesters. In many jurisdictions, police officers carry firearms, primarily handguns, in the normal course of their duties. In the United Kingdom , Iceland, Ireland, Norway, New Zealand, and Malta, with the exception of specialist units, officers do not carry firearms as a matter of course. Norwegian police carry firearms in their vehicles, but not on their duty belts, and must obtain authorization before the weapons can be removed from the vehicle. Police development-aid to weak, failed or failing states is another form of transnational policing that has garnered attention. Intelligence-led policing is now common practice in most advanced countries and it is likely that police intelligence sharing and information exchange has a common morphology around the world .

In 1797, Patrick Colquhoun was able to persuade the West Indies merchants who operated at the Pool of London on the River Thames to establish a police force at the docks to prevent rampant theft that was causing annual estimated losses of £500,000 worth of cargo. The idea of a police, as it then existed in France, was considered as a potentially undesirable foreign import. In building the case for the police in the face of England’s firm anti-police sentiment, POLICE Full Form, What is the Full form of POLICE? Colquhoun framed the political rationale on economic indicators to show that a police dedicated to crime prevention was «perfectly congenial to the principle of the British constitution». Moreover, he went so far as to praise the French system, which had reached «the greatest degree of perfection» in his estimation. In many regions of pre-colonial Africa, particularly West and Central Africa, guild-like secret societies emerged as law enforcement.

Police Unit and Task Force Acronyms

These are known by a variety of names, such as reserves, auxiliary police or special constables. In Australia, organized law enforcement emerged soon after British colonization began in 1788. The first law enforcement organizations were the Night Watch and Row Boat Guard, which were formed in 1789 to police Sydney. Their ranks were drawn from well-behaved convicts deported to Australia. In New South Wales, rural law enforcement officials were appointed by local justices of the peace during the early to mid 19th century, and were referred to as «bench police» or «benchers». With the initial investment of £4,200, the new force the Marine Police began with about 50 men charged with policing 33,000 workers in the river trades, of whom Colquhoun claimed 11,000 were known criminals and «on the game». The force was part funded by the London Society of West India Planters and Merchants.

- The police force was further reformed during the New Kingdom period.

- Some countries have police forces that serve the same territory, with their jurisdiction depending on the type of crime or other circumstances.

- Police forces are usually organized and funded by some level of government.

- The county sheriff, who was an elected official, was responsible for enforcing laws, collecting taxes, supervising elections, and handling the legal business of the county government.

- A few years after the Indian Constitution was created, the Indian Police Service was established under Article 312 of the Indian Constitution.

- The police who wear uniforms make up the majority of a police service’s personnel.

The police who wear uniforms make up the majority of a police service’s personnel. Their main duty is to respond to calls to the emergency telephone number. When not responding to these call-outs, they will do work aimed at preventing crime, such as patrols. The uniformed police are known by varying names such as preventive police, the uniform branch/division, administrative police, order police, the patrol bureau/division or patrol. In Australia and the United Kingdom, patrol personnel are also known as «general duties» officers. Atypically, Brazil’s preventive police are known as Military Police.

Uniformed

When people protect themselves from criminal acts, this is called crime prevention. Have the authority to investigate crimes in their area and to appear in court on behalf of the police station or the site. SHO is the head or officer responsible of a police station of a part. The advent of the police car, two-way radio, and telephone in the early 20th century transformed policing into a reactive strategy that focused on responding to calls for service away from their beat.

Savannah Police officer who killed Carver Village man fired for DUI, lying to Liberty County deputy – Yahoo News

Savannah Police officer who killed Carver Village man fired for DUI, lying to Liberty County deputy.

Posted: Fri, 28 Oct 2022 09:00:54 GMT [source]

Other Scottish towns soon followed suit and set up their own police forces through acts of parliament. In Ireland, the Irish Constabulary Act of 1822 marked the beginning of the Royal Irish Constabulary.

Common Police Jargon

The Police Service of Northern Ireland is investigated by the Police Ombudsman for Northern Ireland, an external agency set up as a result of the Patten report into policing the province. In the Republic of Ireland the Garda Síochána is investigated by the Garda Síochána Ombudsman Commission, an independent commission that replaced the Garda Complaints Board in May 2007. They enforce Muslim dietary laws, prohibit the consumption or sale of alcoholic beverages and pork, and seize banned consumer products and media regarded as un-Islamic, such as CDs/DVDs of various Western musical groups, television shows and film. In Saudi Arabia, the Mutaween actively prevent the practice or proselytizing of non-Islamic religions within Saudi Arabia, where they are banned. Two members of the Taliban religious police (Amr bil Ma-roof, or department for the Promotion of Virtue and Prevention of Vice) beating a woman for removing her burqa in public. In some cases, police are assigned to work «undercover», where they conceal their police identity to investigate crimes, such as organized crime or narcotics crime, that are unsolvable by other means. In some cases this type of policing shares aspects with espionage.

The candidates selected for the SPS are usually posted as Deputy Superintendent of Police or Assistant Commissioner of Police once their probationary period ends. On prescribed satisfactory service in the SPS, the officers are nominated to the Indian Police Service.

Updated List of Tuition Free Universities in Germany for 2022

During the Law Enforcement Training, you will get to learn other skills that will help you when you become a Police officer such as communication, negotiation, stress management, etc. A fitness examination https://simple-accounting.org/ is necessary to make you eligible for a Police officer. After you get the job, you need to check your body shape to ensure you are fit to chase a suspect, perform herculean tasks, jump a fence, etc.

The Talmud also mentions city watchmen and mounted and armed watchmen in the suburbs. Law enforcement in ancient China was carried out by «prefects» for thousands of years since it developed in both the Chu and Jin kingdoms of the Spring and Autumn period. In Jin, dozens of prefects were spread across the state, each having limited authority and employment period. They were appointed by local magistrates, who reported to higher authorities such as governors, who in turn were appointed by the emperor, and they oversaw the civil administration of their «prefecture», or jurisdiction. Under each prefect were «subprefects» who helped collectively with law enforcement in the area. Some prefects were responsible for handling investigations, much like modern police detectives. Local citizens could report minor judicial offenses against them such as robberies at a local prefectural office.

Get the free upfs full form police

In the 1700s, the Province of Carolina (later North- and South Carolina) established slave patrols in order to prevent slave rebellions and enslaved people from escaping. By 1785 the Charleston Guard and Watch had «a distinct chain of command, uniforms, sole responsibility for policing, salary, authorized use of force, and a focus on preventing crime.» In India, the police are under the control of respective States and union territories and is known to be under State Police Services .

- In contrast, the police are entitled to protect private rights in some jurisdictions.

- Getting a bachelor’s degree is optional but could be wanted for advanced law enforcement positions.

- One of the oldest, cop, has largely lost its slang connotations and become a common colloquial term used both by the public and police officers to refer to their profession.

- He has the authority to conduct investigation of crimes in his area and to look in the court on behalf of his police station.

What Is Process Costing? Definition, Features, Procedure and Example

Content

Figure 4.5 «Summary of Costs to Be Accounted for in Desk Products’ Assembly Department» shows that costs totaling $386,000 must be assigned to completed units transferred out and units in ending WIP inventory. Hence, it ascertains the total cost and unit cost of a process, for all the processes carried out in industry.

The Real Cost of Baby-Making – Diversifying with Delyanne Barros – Podcast on CNN Audio – CNN

The Real Cost of Baby-Making – Diversifying with Delyanne Barros – Podcast on CNN Audio.

Posted: Mon, 22 Aug 2022 09:56:15 GMT [source]

The entity has provided the following information & wants to calculate the cost involved in each manufacturing step. Also, it intends to calculate the value of closing inventory. First-in-first-out Inventory MethodUnder the FIFO method of accounting inventory valuation, the goods that are purchased first are the first to be removed from the inventory account. As a result, leftover inventory at books is valued at the most recent price paid for the most recent stock of inventory. As a result, the inventory asset on the balance sheet is recorded at the most recent cost.

Basic Managerial Accounting Terms Used in Job Order Costing and Process Costing

Brainyard delivers data-driven insights and expert advice to help businesses process costing system definition discover, interpret and act on emerging opportunities and trends.

The eyes of a ship, part 2: IR detection at sea – Laser Focus World

The eyes of a ship, part 2: IR detection at sea.

Posted: Mon, 29 Aug 2022 13:42:16 GMT [source]

Process-wise records are maintained, including those relating to the quantity of production, scrap, wastage, etc. All expenses—direct and indirect—are accumulated and classified according to the process. The processing sequence is specific and predetermined. Homogeneous products with identical and standardized features ensure quality. The end product is the result of a sequence of processes.

Business in Action 4.1

Prepare a production cost report for the Mixing department for the month of March. Prepare a production cost report for the Mixing department at Calvin Chemical Company for the month of June.

- Process costing is most commonly used when goods are mass produced and when the costs linked to individual units cannot be easily distinguished from each other.

- Appropriate method is used in absorption of overheads to the process cost centres.

- Therefore, the costs are maintained by each department, rather than by job, as they are in job order costing.

- Assign total costs to units completed and to units in ending work in process inventory.

- It is hard to identify the star performers and poor performers.

- Figure 4.5 «Summary of Costs to Be Accounted for in Desk Products’ Assembly Department» shows that costs totaling $386,000 must be assigned to completed units transferred out and units in ending WIP inventory.

In addition, the costs of inventory under each process are also identified at this change. This method assigns the expense of first inputs to the processes in the order of production.

Distinguish between job costing and process costing

Overhead often includes indirect costs such as equipment maintenance and facility rent, as well as the wages of administrative staff who aren’t directly involved in making the products. Cost assigned to units produced or in process are recorded in the inventory asset account, where it appears on the balance sheet. When the goods are eventually sold, the cost is shifted to the cost of goods sold account, where it appears on the income statement. A process costing system accumulates costs and assigns them at the end of an accounting period. At a very simplified level, the process is noted below.

The journal entries that follow illustrate the accounting for general overhead costs. Therefore, the company would assign costs to the bottling process as a whole for a period of time. Then they would divide that overall process cost by the number of bottles produced during that period of time to assign production costs to each bottle of cola. A fraction-of-a-cent cost change can represent a large dollar change in overall profitability, when selling millions of units of product a month. Managers must carefully watch per unit costs on a daily basis through the production process, while at the same time dealing with materials and output in huge quantities.

Direct Materials Costs

The charging of the cost of the output of one process as the raw materials input cost of the following process. A cost of production report is used to collect, summarize, and compute total and unit cost. Also see formula of gross margin ratio method with financial analysis, balance sheet and income statement analysis tutorials for free download on Accounting4Management.com.

Who uses process costing system?

A process costing system is used by companies that produce similar or identical units of product in batches employing a consistent process. A job costing system is used by companies that produce unique products or jobs.

At the end of the accounting year the balance in the Abnormal Gain Account will be carried to Profit and Loss Account. If the loss is less than the normal expected loss, the difference is considered as abnormal gain. Abnormal gain is accounted similar to that abnormal loss. Abnormal losses are those losses above the level deemed to be the normal loss rate for the process. The abnormal loss is the amount by which the actual loss exceeds the normal loss and it is expected to arise under inefficient operating conditions. Appropriate method is used in absorption of overheads to the process cost centres. The cost and stock records for each process cost centre are maintained accurately.

Similarities between Process Costing and Job Order Costing

Kelley manufactures base paint in two separate departments—Mixing and Packaging. The following information is for the Mixing department for the month of March. Use four steps to assign costs to products using the weighted average method. Are calculated by multiplying the number of physical units on hand by the percentage of completion of the units. If the https://business-accounting.net/ physical units are 100 percent complete, equivalent units will be the same as the physical units. However, if the physical units are not 100 percent complete, the equivalent units will be less than the physical units. In job order cost production, the costs can be directly traced to the job, and the job cost sheet contains the total expenses for that job.

A student’s first thought is that this is easy—just divide the total cost by the number of units produced. However, the presence of work-in-process inventories causes problems. (i.e., direct and indirect costs) for each process, and no abnormal expenses are charged to any process.

By determining what cost the part processed material has incurred such as labor or overhead an «equivalent unit» relative to the value of a finished process can be calculated. Business and industries that use process costing can better contain manufacturing expenses. Under this system, each department is assigned a cost center, which is a number or code that identifies the purchases made by a single department, reports Accounting Coach. This problem is handled through the concept of equivalent units of production. The process costing procedure is explained in more detail in the next example.

Order of Liquidity Crash Course in Accounting and Financial Statement Analysis, Second Edition Book

Content

In order for an asset to be liquid, it must have a market with multiple possible buyers and be able to transfer ownership quickly. Equities are some of the most liquid assets because they usually meet both these qualifications. But not all equities trade at the same rates or attract the same amount of interest from traders. A higher daily volume of trading indicates more buyers and a more liquid stock. Consider a diversity of investments to make capital available when needed. Liquidity is a measure of a company’s ability to pay off its short-term liabilities—those that will come due in less than a year. It’s usually shown as a ratio or a percentage of what the company owes against what it owns.

Still, these are current assets because services against payment processes are yet to be utilized. Liquidity refers to the level of liquid assets a business has in order to meet financial obligations. If you have any other current assets that can easily be converted into cash within a year that do not fit into any of the above categories, list them here. Marketable securities are investments that can be readily converted into cash and traded on public exchanges. This applies to cryptocurrency, for example, and other more standard marketable securities and short-term investments that are easy to sell. While cash is the most obvious current asset, it’s not the only one. Here are the seven main types of current assets, listed in https://www.bookstime.com/ .

Order of Permanence

A liquid asset is cash on hand or an asset other than cash that can be quickly converted into cash at a reasonable price. In other words, a liquid asset can be quickly sold order of liquidity on the market without a significant loss of its value. Investments are cash funds or securities that you hold for a designated purpose for an indefinite period of time.

- Think about ways to cut costs, such as paying invoices on time to avoid late fees, holding off on making capital expenditures and working with suppliers to find the most cost-efficient payment terms.

- A company or individual could run into liquidity issues if the assets cannot be readily converted to cash.

- Additionally, you can analyze historical trends in your assets and liabilities to ensure your business is running properly, or to identify problem areas quickly.

- Companies want to have liquid assets if they value short-term flexibility.

- Conversion to cash depends entirely on the presence of an active after-market for these items.

In practice, the most widely used title is Balance Sheet; however Statement of Financial Position is also acceptable. Naturally, when the presentation includes more than one time period the title «Balance Sheets» should be used. FREE INVESTMENT BANKING COURSELearn the foundation of Investment banking, financial modeling, valuations and more. Bank – The balance available is also the liquidated assets without further conversion. Intangible assets – Nonphysical assets such as patents, copyrights, licenses, and franchise agreements. Prepaid expenses – Valuables you’ve already paid for such as insurance or rent. Customers Trusted from startup to enterprise, from tech to complex farming operations.

Crash Course in Accounting and Financial Statement Analysis, Second Edition by Matan Feldman, Arkady Libman

The current ratio is used to provide a company’s ability to pay back its liabilities with its assets . Of course, industry standards vary, but a company should ideally have a ratio greater than 1, meaning they have more current assets to current liabilities. However, it’s important to compare ratios to similar companies within the same industry for an accurate comparison. That presents the company’s assets, liabilities, and owners’ equity at a particular point in time, thereby providing insights into an entity’s financial position.

- Measuring liquidity can give you information for how your company is performing financially right now, as well as inform future financial planning.

- These measures can give you a glimpse into the financial health of the business.

- Balance sheets are a tool that help investors, lenders, stakeholders, and external regulators gauge the financial position of a business, what resources are currently available, and how they were financed.

- Bank – The balance available is also the liquidated assets without further conversion.

- The other assets are only held because they provide useful services and are excluded from the current asset classification.

You should make these investments in securities that can be converted into cash easily; usually short-term government obligations. IlliquidIlliquid refers to an asset that cannot be converted to cash. Such assets suffer a valuation loss when sold in exchange for cash.

Build your dream business for $1/month

Even when your business is on track to succeed in the long-term, current assets can be helpful if you need extra money to cover short-term expenses. These ratios are also a way to benchmark against other companies in your industry and set goals to maintain or reach financial objectives. This shows the company’s capacity to pay off short-term debt with cash and cash equivalents, the most liquid assets. These expenses are payments made for services that will be received in the near future. Strictly speaking, your prepaid expenses will not be converted to current assets in order to avoid penalizing companies that choose to pay current operating costs in advance rather than to hold cash. Balance SheetA balance sheet is one of the financial statements of a company that presents the shareholders’ equity, liabilities, and assets of the company at a specific point in time. It is based on the accounting equation that states that the sum of the total liabilities and the owner’s capital equals the total assets of the company.

Current assets include cash and other assets that in the normal course of events are converted into cash within the operating cycle. For example, a manufacturing enterprise will use cash to acquire inventories of materials. These inventories of materials are converted into finished products and then sold to customers. Materials are not purchased for conversion into finished products. Instead, the finished products are purchased and are sold directly to the customers.

Investments include stocks or the bonds you may hold for another company, real estate or mortgages that you are holding for income-producing purposes. Your investments also include money that you may be holding for a pension fund.

Analytical Procedures in Auditing: Definition and Its Importance

Like ISA 315, ISA 520 also requires auditors to use analytical procedures. This time, however, it relates to after the fieldwork that auditors perform. This standard deals with using analytical procedures as an overall review after the end of the audit. It aims to evaluate whether the financial statements are consistent with the auditor’s understanding of the client. 1 DisaggregationThe more detailed the level at which analytical procedures are performed, the greater the potential precision of the procedures. Analytical procedures performed at a high level may mask significant, but offsetting, differences that are more likely to come to the auditor’s attention when procedures are performed on disaggregated data. The objective of the audit procedure will determine whether data for an analytical procedure should be disaggregated and to what degree it should be disaggregated.

- Dương Khoa Vũ đang tìm kiếm từ khóa Which of the following responsibilities would most likely compromise the independence of an is auditor when reviewing the risk management process?

- Analytical review is not the procedure that uses to obtain audit evidence.

- These two ratios are less than the better benchmark 2, even are lower than positive current ratio 1.5 as well.

- This is because internal control over financial reporting is different from one client to another, and the control might change from time to time.

An infant company often does not generate numbers comparable to more mature entities. But we’ll keep this choice in our quiver–just in case. A second option is to calculate ratios common to the entity’s industry and compare the results to industry benchmarks. Here are my suggestions for documenting preliminary planning analytics. Now, let’s discuss the best types of planning analytics. But before creating your planning analytics, you first need to know what to expect.

Analytical review

Audit inquiry is sometimes used by the auditor to obtain the audit evidence and sometimes is used to understand some nature of business or accounting transactions to gain enough knowledge to design and perform testing. The https://online-accounting.net/ auditor might need to update audit procedures from time to time even though its firm or team had audited current financial statements. Using CAATTs in preliminary analytical review to enhance the auditor’s risk assessment.

Apply substantive procedures, such as analytical or tests of details, or a combination of both, to respond to identified risks of material misstatement at the assertion level. Analytical procedures are a type of evidence used during an audit. These procedures can indicate possible problems with the financial records of a client, which can then be investigated more thoroughly. Analytical procedures involve comparisons of different sets of financial and operational information, to see if historical relationships are continuing forward into the period under review. If not, it can imply that the client’s financial records are incorrect, possibly due to errors or fraudulent reporting activity. Auditors conduct risk assessments, known as preliminary analytical reviews, to plan and time their strategies for conducting an initial analysis. SIMILAR PRIOR-PERIOD DATA The gross margin percentage for a company has been between 26% and 27% for the past 4 years but has dropped to 23% in the current year?

Substantive tests

For example, the auditor might inquire about management at the planning stage. The auditor could also inquire management to confirm the consignment liabilities at the end of the audit work. Identify two types of information in the clients minutes of the board of directors meeting that are likely to be relevant to the auditor. Explain why it is important to read the minutes early in the engagement. What factors should an auditor consider prior to accepting an engagement? PRECAUTIONSLymphoma And Other MalignanciesPatients receiving immunosuppressants, including PROGRAF, are at increased risk of developing lymphomas and … The comparison of the expected results to the actual amounts or ratios for the period.

The source of the information available is particularly important. Internal data produced from systems and records that are covered by the audit, or that are not subject to manipulation by persons in a position to influence accounting activities, are generally considered more reliable. Investigate the reason.The auditor brainstorms all possible causes and then determines the most probable cause for each discrepancy. Identify differences between expected and reported amounts.The auditor must compare her expectation with the amount recorded in the company’s accounting system and then compare the result to the auditor’s threshold for analytical testing. When relevant, use nonfinancial information, such as the number of products sold. If a company sells just three or four products and you have the sales statistics, why not compute the estimated revenue and compare it to the recorded revenue?

Data Analytics

It should state services to be provided, restrictions imposed on the auditor’s work, deadlines for completing the audit, and assistance to be provided by client personnel. Properly designed and executed analytical procedures can allow the auditor to achieve audit objectives more efficiently by reducing or replacing other detailed audit testing. Reasonableness testing – the analysis of accounts, or changes in accounts between accounting periods, that involves the development of a model to preliminary analytical procedures examples form an expectation based on financial data, non – financial data, or both. Analytical review processes are one type of financial audit. Review the applicable terms and concepts, including audit tests and analytical review, and learn why the process is effective in evaluating financial stability as well as unexpected variations. May mask significant, but offsetting, differences that are more likely to come to the auditor’s attention when procedures are performed on disaggregated data.

It’s important to note that ratio analysis can be used at this stage to identify logical relations. An increase in marketing expense is logical with the increase in sales. Similarly, the following examples can be helpful to understand the concept. Multiply the number of employees by average pay to estimate the total annual compensation, and then compare the result to the actual total compensation expense for the period. The client must explain any material difference from this amount, such as bonus payments or employee leave without pay. Auditing standards don’t specify what types of planning analytics to use. But some, in my opinion, are better than others.Here’s my suggested approach .

The Time is Now

At your convenience, please use the form below or call for an initial one-hour free consultation. My sweet spot is governmental and nonprofit fraud prevention. I am the author of The Little Book of Local Government Fraud Prevention, Preparation of Financial Statements & Compilation Engagements, The Why and How of Auditing, and Audit Risk Assessment Made Easy. Additionally, I frequently speak at continuing education events. I am a practicing CPA and Certified Fraud Examiner. For the last thirty years, I have primarily audited governments, nonprofits, and small businesses. The last option we’ve listed is a review of the budgetary comparisons.

This interpretation is carried in relation to factual information; this information can be obtained from internal/external sources. Compare the ending balances in the compensation expense account for several years. Unusual spikes may indicate that fraudulent payments are being made to fake employees through the payroll system. Unusual or Unexpected Relationships Potential Implications to the Audit Increased sales with decreased inventories Improper revenue recognition, theft of inventory, inventory valuation issues, physical inventory observation errors, etc.

Audit planning level

Sales transactions were not processed in the correct periods. It may not be possible to collect accounts receivable. This means adding up the receipts on the accounts receivable, which are, essentially, the accounts held by debtors, to verify that the total they traced to the general ledger is correct. Multiplying the number of employees by average pay to estimate the total annual compensation and then comparing the result to the actual total compensation expense for the period.

Data Exchange Application DEXA

Content

Budgeting apps can help track your personal finances to give you an overall picture of what you’re earning, what you’re spending, and what you may need to change. They’re typically designed for general personal budgeting; each app offers some standard, basic features, along with unique tools to help you build strong financial habits. Some budgeting apps https://www.bookstime.com/ can also help you track credit card balances and money in banks and brokerages. You quickly receive a snapshot of your “net worth” , and Simplifi offers a multitude of colorful graphs that neatly show your spending, savings, and income over time. It offers more reports than competing budgeting apps and more control over how the information is presented.

Pinpoint your money habits by taking inventory of all of your accounts, including your checking account and all credit cards you have. Looking at your accounts will help you identify your spending patterns. Budgeting is the practice of blueprinting how much you’ll spend and earn in the future, and then tracking and adjusting those expectations as you experience real life. The point of a budget is to help control your personal finances so you live within your means, build up savings, and avoid taking on unnecessary debt. Personal finance writer Helaine Olen makes a case in Slate for why such a meticulous and exacting approach to personal budgeting may be misguided. The crux of her argument is that most people’s income and expenses vary enough from month to month to render a budget useless.

Budget Template File

On EnterpriseOne Data Sources, select the local data source so that the table conversion program can access the data that you copied into the F0902Z2.txt file. Use these processing options to specify the default values on the Upload Records to F0902Z1 form. Before you upload your budget data to the F0902 table, use the Upload/Conversion Revisions program to verify that the data is correct and revise the data, if necessary. EveryDollar is an ideal choice for families who want to take a hands-on approach to budget together. It allows you to allocate every dollar that you’re spending and provides a customizable template to make the budgeting process easier.

For instance, let’s assume you typically drop $100 a week at the grocery store. But Thanksgiving is coming up, and you breeze well past your normal amount on turkey, pie, and wine. Rather than readjust the rest of your budget to account for this temporary spike—as you would with a zero-based budget where every dollar is planned out for the month—you adjust your behavior on the fly. Because you know you have less for everything else, and you’re closely monitoring your “left to spend” number, you intuitively purchase only three bottles of wine for dinner rather than four. Subscriptions are recurring payments that don’t incur a late fee if not paid on time . You could also categorize expenses as bills if they’re a priority to pay and use the subscriptions category for non-essential expenses. But if the distinction between bills and subscriptions isn’t clear or useful for you, you can simply categorize all recurring payments as bills.

Features our users love

She is a certified public accountant who owns her own accounting firm, where she serves small businesses, nonprofits, solopreneurs, budgeting report freelancers, and individuals. Keep your personal and financial information safe with identity theft protection services.

- For example, you create an envelope for your monthly groceries, another for utilities and another for rent.

- The number of credits you have is determined by the user types in your subscription.

- It’s important to know not only what your credit score is at any given time, but also how it gets calculated and what you can do to improve it.

- You’ll be rewarded with an annual bonus on your savings and can easily track savings goals.

- App plans to launch a pandemic-inspired feature allowing people to prioritize “envelopes” based on their most urgent expenses, such as housing, utility bills, etc.

- Users can find information on a single credit union or analyze broader nation-wide trends.

Specify an annual budget upload instead of uploading periodic amounts. Use the Upload/Conversion Revisions program to correct any errors in the F0902Z1 table.

Best free smartphone app for beginners

By clicking «TRY IT», I agree to receive newsletters and promotions from Money and its partners. I agree to Money’s Terms of Use and Privacy Notice and consent to the processing of my personal information. Credits for tiled imagery storage are calculated based on the size of the image files stored.

- This budgeting app links to all of your financial accounts and helps you track your spending compared to your budget throughout the month.

- Credit usage for imagery analysis depends on the number of pixels or features processed, which incorporates the number of bands in multiband imagery and the number of slices in multidimensional data.

- Although you can use fancy budgeting software, sometimes a simple sheet of paper or a spreadsheet can be sufficient.

- Zero-based budgeting is a budgeting style wherein the sum of your income minus your expenses equals zero.

- If the privacy of your financial information is a concern, make sure to look at the type of encryption the app uses.

Buddy is not part of our list because it’s not available on the Google Play store. Basically, this overview shows you snippets and highlights of the data analysis these services do behind the scenes, with options to dive deeper.